Copyright © 2024 Multiple Mortgage All Rights Reserved.

Mortgage Cash Rebate 2.2% The Highest ever!

Multiple Exclusive Offer

Plan 1

H+1.3%

Mortgage Cash Rebate 1.93%

Applicable to Home Ownership Scheme

Plan 2

H+1.3%

Mortgage Cash Rebate up to 2.2%

Applicable to First & Second Hand Property

Plan 3

H+1.3%

Mortgage Cash Rebate up to 2.2%

Applicable to Mortgage Refinance

Bank Special Plan

Subdivided housing, self-employed people without tax bills, debt consolidation, asset approval (suitable for those with insufficient income), tenements, village houses, etc.

WhatsApp Cash Rebate Enquiry

Miss Lau

6332 2553

Latest Offers

New HOS prospective owners can get an extra $300 cash rebate from pre-Whatsapp registration.

Enquiry 6332 2553 (Miss Lau)

Or directly click the following Whatsapp link to register:

New HOS

6332 2553

New HOS and Green Home Ownership mortgages, interest rate H+1.3%,

with a cash rebate of 1.93%. New HOS and Green Home Owners who pre-register with Whatsapp can get an additional $300 in cash rebate,

and will be directly referred to 4 HOS mortgage- banks without a third party. Customers are welcome to compare the actual rebate amount.

More than 45,000 cases have been referred by us since year 2000.

Valuation

Free Property Valuation

Real-Time Bank Mortgage Information

Real-time access to major banks through API (Application Program Interfaces), mortgage information is fast and accurate

API is a way to facilitate the exchange of information and the execution of instructions between different computer systems. Open API allows third parties to connect to an organization's internal systems through API.

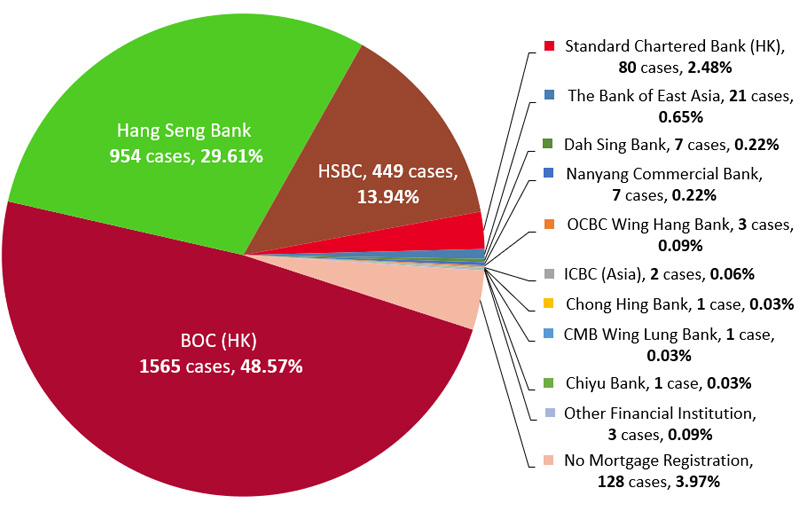

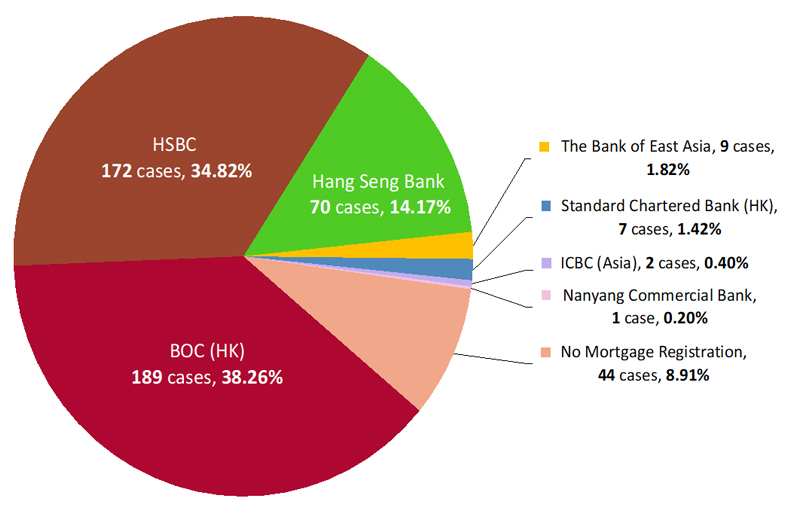

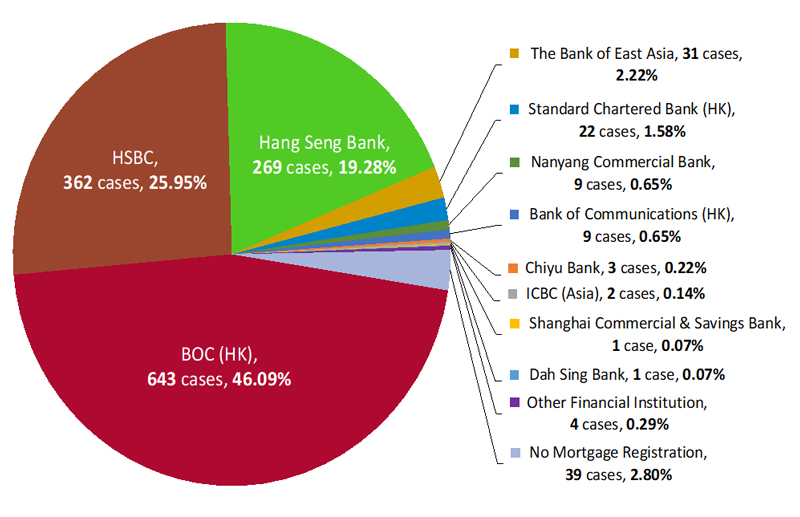

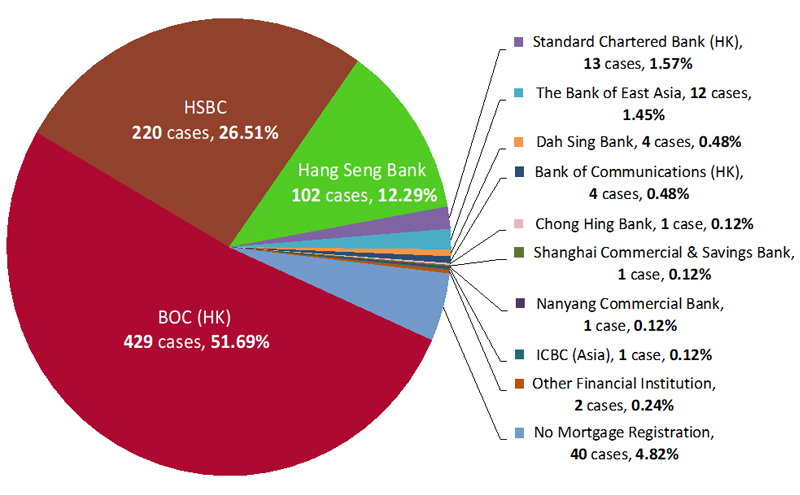

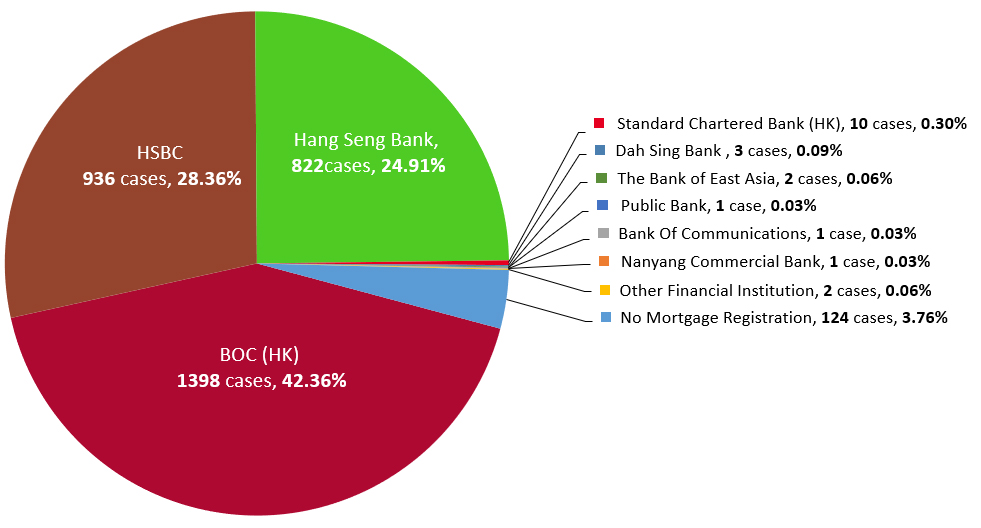

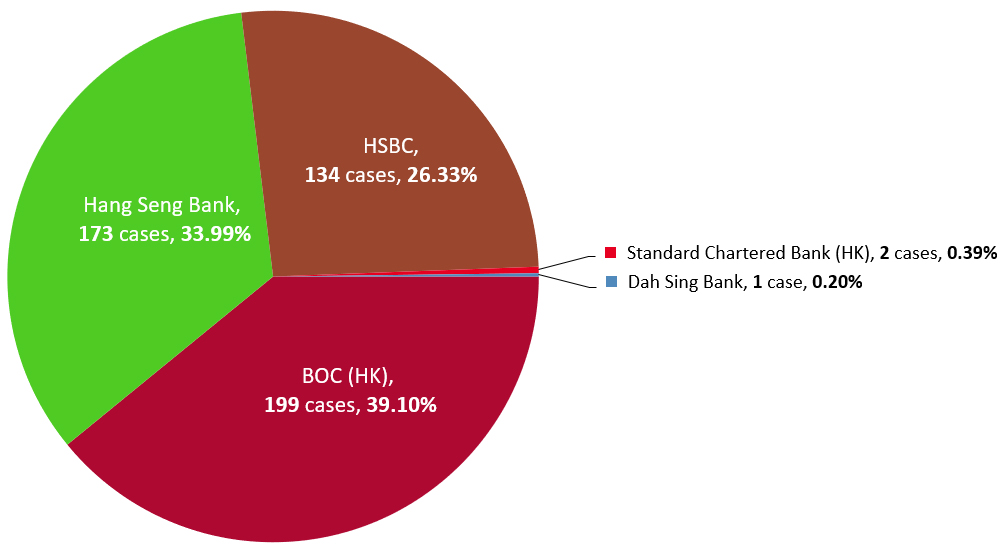

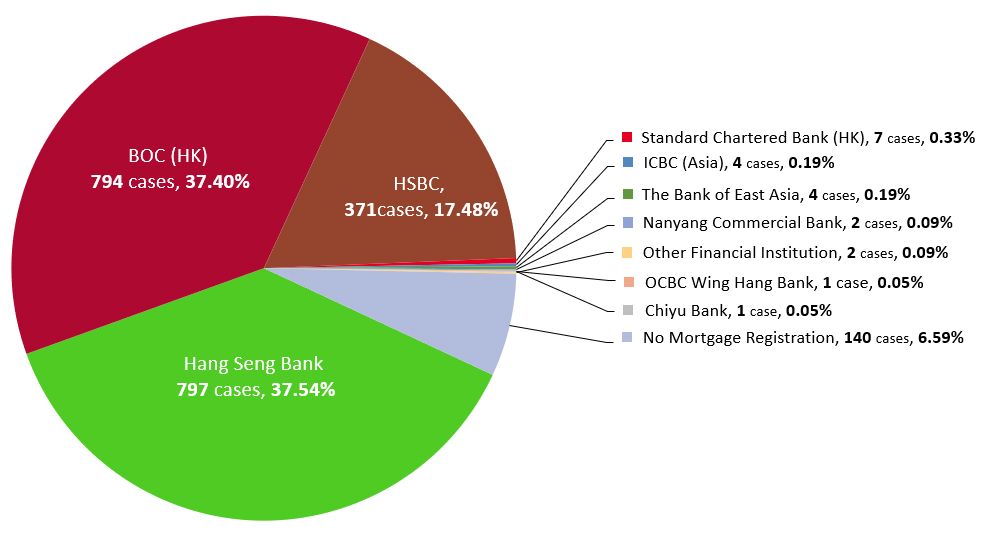

2018-2022 HOS / GSH Mortgage Market Share

|

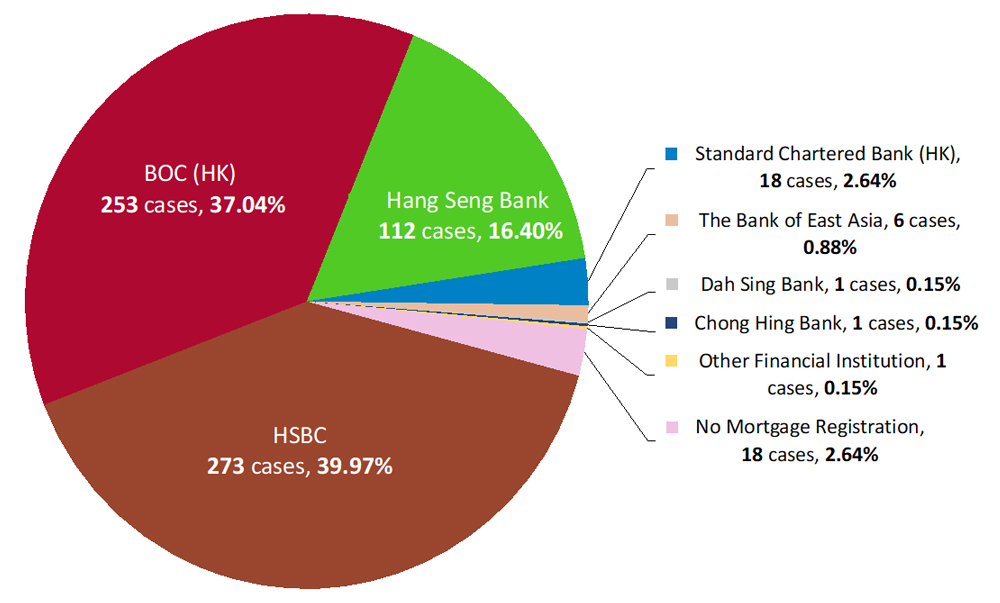

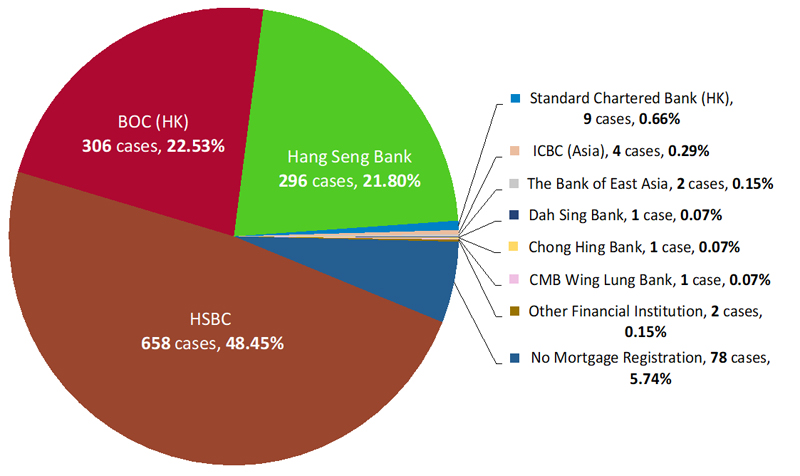

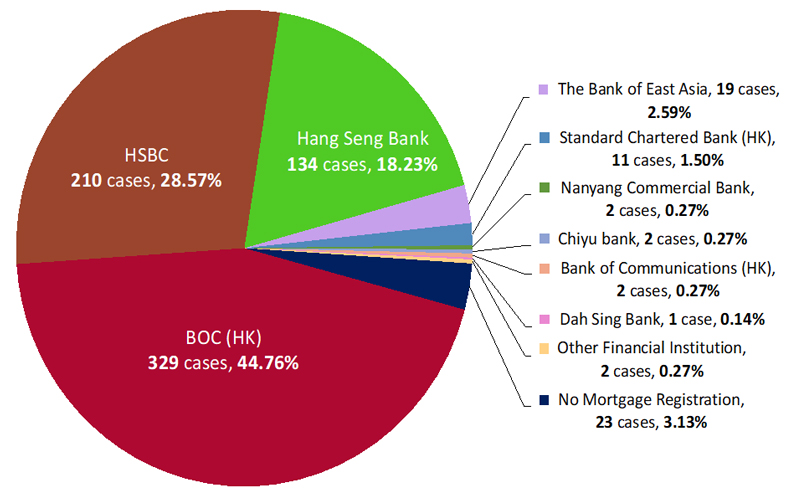

Kai Long Court was sold in March 2019, with a total of 683 flats, all of which have been sold out. The mortgage was registered at the Land Registry from April 15 to June 26 2019. 664 of the flats have been mortgaged by major banks.

|

||||||

| ||||||

|

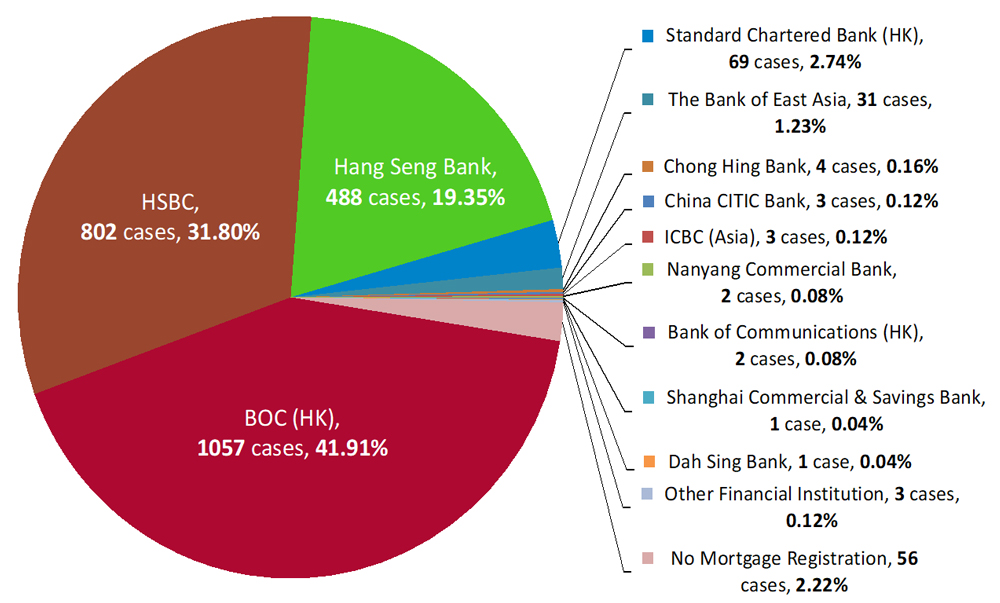

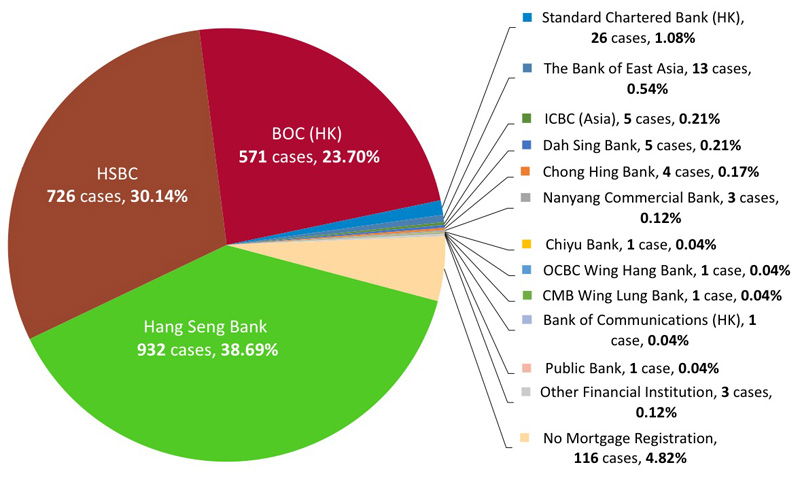

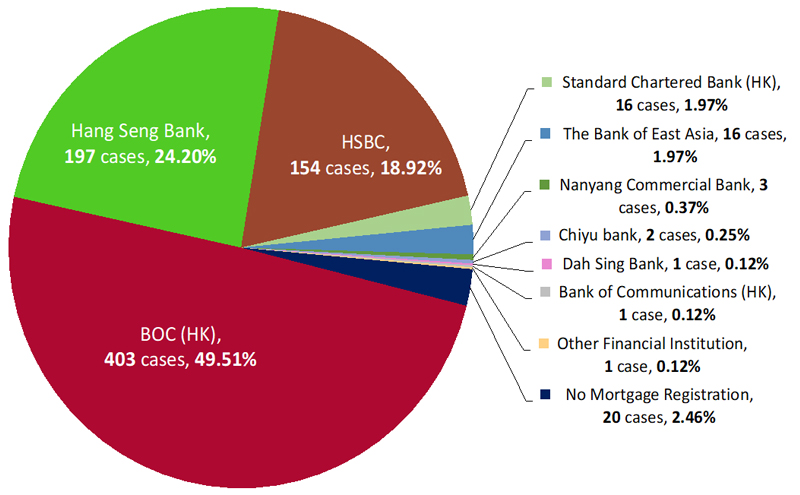

Hoi Lok Court was sold in March 2019, with a total of 2,522 flats, all of which have been sold out. The mortgage was registered at the Land Registry from April 16th to November 6th 2019. 2,463 of the flats have been mortgaged by major banks.

|

||||||

| ||||||

|

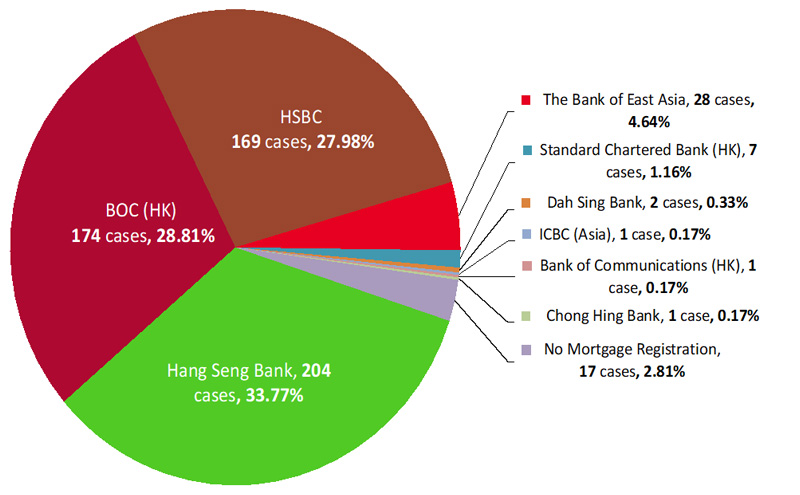

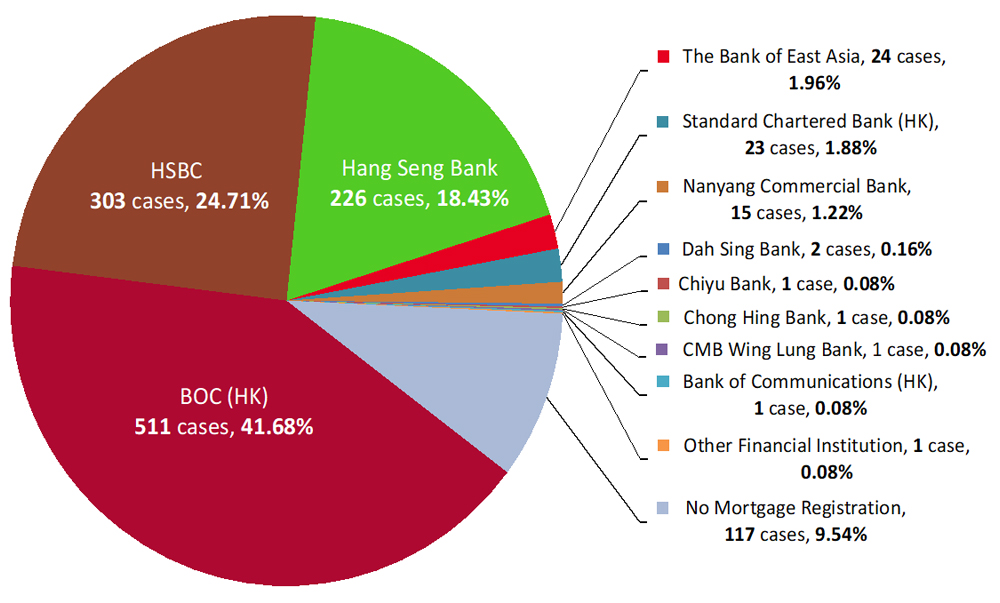

Kwun Tak Court was sold in December 2019, with a total of 603 flats, all of which have been sold out. The mortgage was registered at the Land Registry from January 23rd to April 27th 2020. 588 of the flats have been mortgaged by major banks.

|

||||||

| ||||||

|

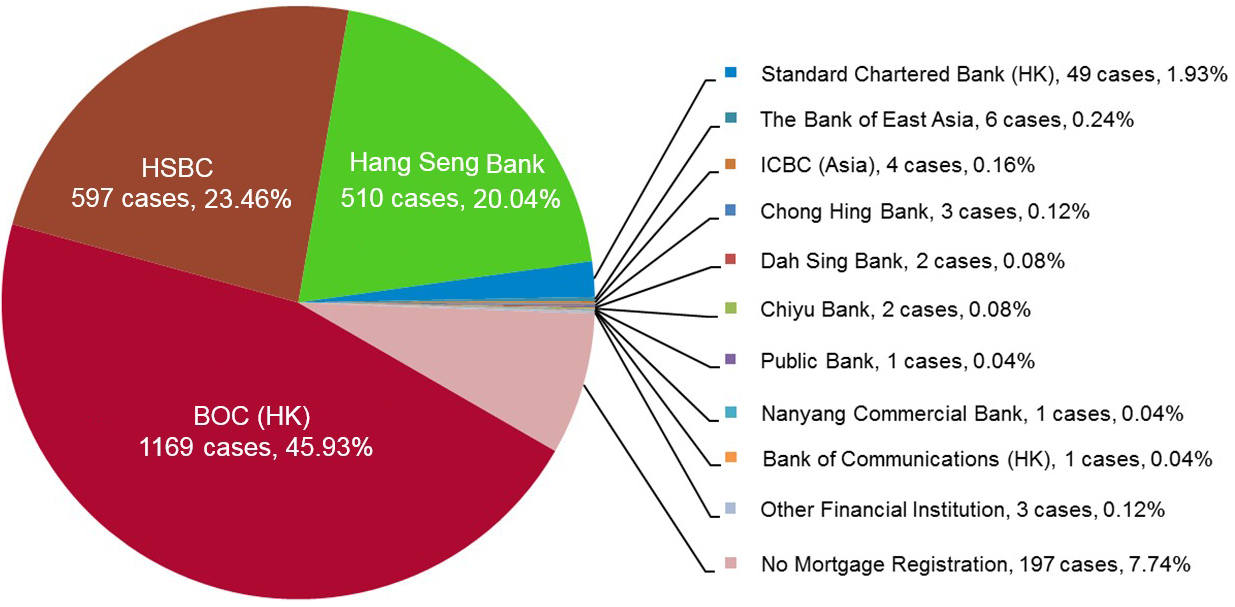

Lai Tsui Court (Blocks 1-4), a total of 2,545 units were selected in April 2019, and all were sold out. The mortgage was registered at the Land Registry from September 16 to November 6, 2019, and 2,348 units have been sold by major Banks make mortgages.

|

||||||

| ||||||

|

Choi Hing Court, from August to September 2017, a total of 1,358 units were sold, and the mortgage was registered at the Land Registry from May 7 to June 13, 2019. 1,278 units have been mortgaged by major banks .

|

||||||

| ||||||

|

Ping Yan Court, from July to December 2016, a total of 2409 units were sold, and the mortgage was registered at the Land Registry from November 6 to December 20, 2018. 2293 units have been mortgaged by major banks.

|

||||||

| ||||||

|

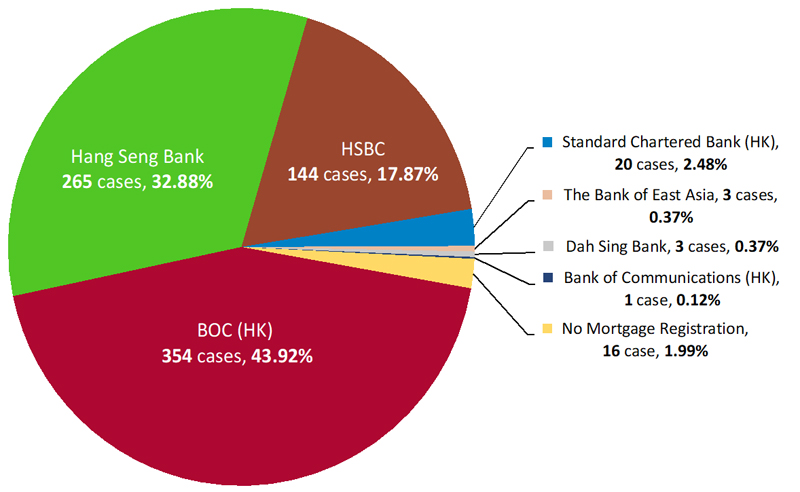

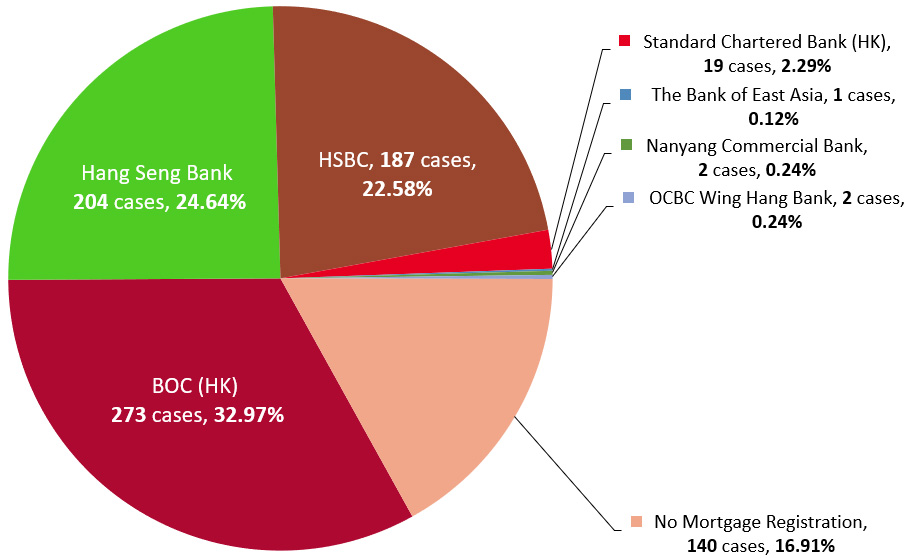

Yu Tai Court was sold from February to May 2019, with a total of 1226 units, all sold out. The mortgage information was registered at the Land Registry from December 24th 2020 to February 21st 2022. 1108 of the units have been mortgaged by major banks.

|

||||||

| ||||||

|

Choi Wo Court was sold from May 31st to July 29th 2021; with a total of 806 units, all sold out. The mortgage information was registered at the Land Registry from July 9th to February 7th 2022. 790 of the units have been mortgaged by major banks.

|

||||||

| ||||||

|

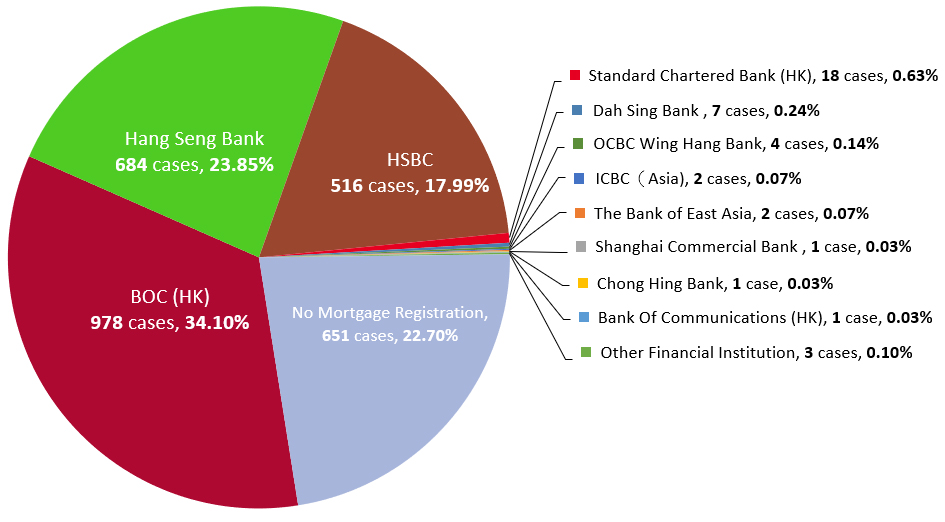

Shan Lai Court was sold from May 31st to September 12th 2021; with a total of 3,222 units, all sold. The mortgage information was registered at the Land Registry from December 8th 2021 to March 13th 2023. 3,091 of the units have been mortgaged by major banks.

|

||||||

| ||||||

|

Sheung Man Court was sold from December 2019 to May 2020; with a total of 494 units, all sold out. The mortgage information was registered at the Land Registry from July 23rd 2020 to August 9th 2021. 450 of the units have been mortgaged by major banks.

|

||||||

| ||||||

|

Yung Ming Court was sold from December 2019 to May 2020; with a total of 1395 units, all sold out. The mortgage information was registered at the Land Registry from November 12th 2020 to August 5th 2021. 1352 of the units have been mortgaged by major banks.

|

||||||

| ||||||

|

Yuk Wo Court was sold from January to June 2020, with a total of 830 units, all sold out. The mortgage information was registered at the Land Registry from July 31st 2020 to September 10th 2021. 788 of the units have been mortgaged by major banks

|

||||||

| ||||||

|

Kam Fai Court was sold from December 2019 to june 2020, with a total of 735 units, all sold out. The mortgage information was registered at the Land Registry from September 14th 2020 to August 11th 2021. 710 of the units have been mortgaged by major banks.

|

||||||

| ||||||

|

Hoi Tak Court was sold from December 2019 to May 2020, with a total of 814 units, all sold out. The mortgage information was registered at the Land Registry from November 10th 2020 to August 5th 2021. 793 of the units have been mortgaged by major banks.

|

||||||

| ||||||

|

Dip Tsui Court was sold from 29th June 2020 to 3rd January 2022, a total of 828 units were all sold out. Mortgage registration was at the Land Registry from 26th July 2022 to 31th May 2023, 688 units have been mortgaged by major banks.

|

||||||

| ||||||

|

Ching Fu Court was sold from June 2021 until March 2023, with a total of 2868 flats, The mortgage was registered at the Land Registry from April 3rd 2023 to July 25th 2023, 2214 of the flats have been mortgaged by major banks.

|

||||||

| ||||||

|

Yu Nga Court was sold from 15th November 2022 until 17th February 2023, with a total of 3300 flats, all of which have been sold out, The mortgage was registered at the Land Registry from January 3rd to July 25th 2023, 3174 of the flats have been mortgaged by major banks.

|

||||||

| ||||||

|

Yu Tak Court was sold from November 2022 until February 2023, with a total of 3300 flats, all of which have been sold out, The mortgage was registered at the Land Registry from May 17th to July 6th 2023, 509 of the flats have been mortgaged by major banks.

|

||||||

| ||||||

|

Kam Chun Court was sold from May 2021 until September 2021, with a total of 2079 flats, all of which have been sold out, The mortgage was registered at the Land Registry from 30th May 2023 to 21st July 2023, 1983 of the flats have been mortgaged by major banks.

|

||||||

| ||||||

|

Details of flats for sale in HOS 2023

|

||||||

| District | Estate | No. of Unit | Saleable (ft²) |

Price (48% Off) |

Material Date | |

| Tuen Mun | Siu Tsui Court | 518 | 281-518 | 1.79-3.72 Million | April 30, 2025 | |

| Kwun Tong | On Ying Court | 1,140 | 282-478 | 1.71-3.94 Million | July 31, 2025 | |

| Kwun Tong | On Wah Court | 990 | 296-495 | 1.81-3.77 Million | August 31, 2025 | |

| Kwun Tong | On Lai Court | 1,380 | 278-497 | 1.69-3.76 Million | August 31, 2025 | |

| Kai Tak | Kai Yuet Court | 2,046 | 278-475 | 2.23-4.94 Million | October 31, 2025 | |

| Yuen Long | Long Tin Court | 3,080 | 280-454 | 1.49-3.18 Million | March 31, 2026 | |

| Total : | 9,154 | |||||

HOS 2022

The balloting ceremony of Home Ownership Scheme (HOS) Flats 2022 and White Form Secondary Market Scheme (WSM) 2022, was held on June 13th 2022. 8,926 HOS units were sold at 51% off the market price (ie: 49% off the market value), with prices ranging from HK$1.24 million to HK$5.31 million, with the downpayment as low as HK$62,000. HOS 2022 estates include Chi Wah Court in North Point, Kwan Shan Court in To Kwa Wan, Kai Yan Court in Kai Tak, On Sau Court in Kwun Tong, Chiu Ming Court in Tseung Kwan O, Yu Tak Court in Shatin and Yu Ya Court in Tung Chung. The accessible area of the units range from 186-555 Square feet.

A spokesman for the Housing Authority (HA) said, "In this phase of HOS, the HA has received a total of around 252,000 applications for HOS 2022 (assembled by around 203,000 white forms and 49,000 green forms); and around 117,000 applications for WSM 2022. Around 222,000 of the HOS 2022 application forms and 110,000 of the WSM 2022 application forms were submitted online.”

Expect to be selected in the fourth quarter of 2022

A spokesman for HA said, "Approval letters will be issued to the successful applicants for HOS 2022 and WSM 2022, the flat selection process has been planned to be carried out in the fourth quarter of 2022.

|

Details of flats for sale in HOS 2022

|

||||||

| District | Estate | No. of Unit | Saleable (ft²) |

Price (49% Off) |

Material Date | |

| North Point | Kei Wah Court | 248 | 280-457 | 2.48-5.31 Million | July 31, 2024 | |

| To Kwa Wan | Kwun Shan Court | 495 | 281-447 | 1.88-3.64 Million | November 30, 2024 | |

| Kai Tak | Kai Yan Court | 1,840 | 186-448 | 1.24-4.79 Million | December 31, 2024 | |

| Kwun Tong | On Sau Court | 1,906 | 279-479 | 1.53-3.25 Million | November 30, 2024 | |

| Tseung Kwan O | Chiu Ming Court | 594 | 283-461 | 1.69-3.35 Million | September 30, 2024 | |

| Shatin | Yu Tak Court | 543 | 281-463 | 1.74-3.37 Million | May 31, 2023 | |

| Tung Chung | Yu Nga Court | 3,300 | 272-555 | 1.3-3.55 Million | September 30, 2022 | |

| Total : | 8,926 | |||||

|

Re-sale unit:

In HOS 2022, 27 units of the Housing Society will be resold at the same time, including Tsui Ling Peak in Tseung Kwan O, Tsui Ming Terrace in Tuen Mun and Luk Yee Court in Shatin. There will also be 15 units in Choi Wo Court in Fo Tan and Shan Lai Court in Fanling in HOS 2020. The re-sale units combined with the new 8,926 units at the moment, amount to 8,968 units.

HOS Mortgage 2022 Offers:

Major banks: P - 2.25% (effective interest rate 3.375%), with a term of up to 25 years. For new HOS prospective homeowners, an additional $300 cash rebate will be given after Whatsapp registration, mortgage cash rebate 2.4%

|

||||||

GSH 2022

香港房屋委員會(房委會)宣布綠置居2022開售,今次總共有三個屋苑合共4,693伙,包括油塘、粉嶺及馬鞍山3個地點,單位會以市價41折推售,最便宜的馬鞍山錦柏苑75.4 萬,若以最少付5%首期計算,買家只需繳付約3.7萬元即可「上車」。綠置居申請者主要為公屋住戶,或持有有效《綠表資格證明書》人士!

|

GSH 2022 - Details of flats sold by the Housing Authority

Selecting Home: From 28 March 2023 (Tuesday)

|

||||||

| District | Estate | No. of Block | No. of Unit | Saleable (ft²) |

Price (59% Off) |

Material Date |

| Yau Tong | Ko Wang Court | 2 | 2,021 | 185-498 | 0.84-2.71 Million | Block A:2025/4/30 Block B:2025/6/30 |

| Ma On Shan | Kam Pak Court | 3 | 1,896 | 184-473 | 0.754-2.61 Million | 2026/7/31 |

| Fan Ling | Ching Tao Court | 1 | 776 | 277-447 | 1.13-2.19 Million | 2025/3/31 |

| Total : | 4,693 | |||||

HOS 2021 - Details of flats sold by the Housing Authority

Selecting Home: From 31 May 2021 (Monday)

| District | Estate | No. of Block | No. of Unit | Saleable (M²) |

Price (40% Off) |

Material Date |

| Fo Tan | Choi Wo Court | 1 | 806 | 36.6-57 | 2.41-4.65 Million | Occupation documents were issued on 14 August 2020 |

| Diamond Hill | Kai Cheung Court | 2 | 940 | 27.4-46.6 | 2.18-4.89 Million | 2023/5/31 |

| Ma On Shan | Kam Chun Court | 5 | 2,079 | 28.9-45.9 | 1.89-3.87 Million | 2023/2/28 |

| Fan Ling | Shan Lai Court | 6 | 3,222 | 25.8-41.9 | 1.17-2.59 Million | 2021/11/30 |

| Total : | 7,047 | |||||

|

Resale unit:

There are 95 units repossessed due to rescission of the sale and purchase agreement and resold in HOS 2020. Including 60 units of Hoi Lok Court and Yu Tai Court sold under HOS 2018, and 35 units of Hoi Tak Court, Kam Fai Court, Sheung Man Court, Yuk Wo Court and Yung Ming Court sold under HOS 2019。

Mortgage Offer:

Big banks: P - 2.5% (effective interest rate 2.5%), with a term of up to 25 years, new HOS prospective homeowners will be given priority for Whatsapp registration and can add an additional $500 cash rebate, mortgage cash rebate 1%

|

||||||

GSH 2020/21

香港房屋委員會(房委會)出售綠表置居計劃「綠置居2020/21」推售的鑽石山啟鑽苑是新建的綠置居發展項目,提供2,112個單位,單位實用面積由約17.1平方米至約44.7平方米不等(即約184平方呎至約481平方呎)。此外,房委會指,另有截至2021年3月31日合共530個在「綠置居2020」未售出或因買賣協議撤銷而收回的柴灣蝶翠苑及青衣青富苑單位,連同截至選樓期開始前約兩個月確知因買賣協議撤銷而收回的單位,將一併納入是次銷售計劃內重售。

|

GSH 2020/21 - Details of flats sold by the Housing Authority

Selecting Home: From 29 October 2021 (Friday)

|

||||||

| District | Estate | No. of Block | No. of Unit | Saleable (ft²) |

Price (50% Off) |

Material Date |

| Diamond Hill | Kai Chuen Court | 3 | 2,112 | 184-481 | 1.18-3.85 Million | 2023/12/31 |

HOS 2019 - Details of flats sold by the Housing Authority

Selecting Home: From 9 December 2019 (Monday)

| District | Estate | No. of Block | Unit | Saleable (ft²) |

Price (41% Off) |

Material Date |

| Ho Man Tin | Kwun Tak Court | 3 | 603 | 445-568 | 3.25-5.29 Million | 2019/9/30 |

| Cheung Sha Wan | Hoi Tak Court | 1 | 814 | 279-522 | 1.95-4.35 Million | 2020/10/31 |

| Kwai Chung | Sheung Man Court | 1 | 494 | 287-459 | 1.77-3.54 Million | 2020/6/30 |

| Tseung Kwan O | Yung Ming Court | 2 | 1,395 | 282-568 | 1.83-4.55 Million | 2020/8/31 |

| Ma On Shan | Kam Fai Court | 1 | 735 | 276-455 | 1.56-3.48 Million | 2020/10/31 |

| Sha Tin | Yuk Wo Court | 1 | 830 | 294-463 | 1.73-3.36 Million | 2020/10/31 |

| Total : | 4,871 | |||||

|

Resale unit:

There are 27 units repossessed due to rescission of the sale and purchase agreement and resold in HOS 2019. Including 27 units of Ka Shun Court, Ping Yan Court,Ngan Wai Court, Ngan Ho Court and Choi Hing Court sold under HOS 2016-2017.

Mortgage Offer:

Big banks: P - 2.5% (effective interest rate 2.5%), with a term of up to 25 years, new HOS prospective homeowners will be given priority for Whatsapp registration and can add an additional $500 cash rebate

|

||||||

GSH 2019

綠置居2019的攪珠結果出爐﹗政府於去年公佈新一期綠置居定價資料,當中包括柴灣蝶翠苑及青衣青富苑的定價資料,兩個項目的定價由97.6萬至273萬元,全部單位以市價49折發售,提供3696個單位。綠置居計劃已於早前截止,並剛於2020年4月6日進行攪珠,同年6月29日揀樓。綠置居項目為公屋居民提供上車機會。兩區地理位置同樣吸引,擁有社區配套,加上以綠置居49折計算,相信可吸引不少「綠表」人士申請。

|

GSH 2019 - Details of flats sold by the Housing Authority

Selecting Home: From 29 June 2019

|

||||||

| District | Estate | No. of Block | No. of Unit | Saleable (ft²) |

Price (51% Off) |

Material Date |

| Chai Wan | Dip Tsui Court | 1 | 828 | 187-320 | 0.976-2.072 Million | 2022/8/31 |

| Tsing Yi | Ching Fu Court | 2 | 2,868 | 152-388 | 0.82-2.73 Million | 2023/4/30 |

| Total : | 3,696 | |||||

HOS 2018

香港房屋委員會(房委會)宣布,新一期居屋「居屋2018」,將於下周四(2018年3月29日)開始接受申請,合資格申請者可於當日起至下月11日期間遞交該兩項計劃的申請表。申請表和申請須知由今日開始可供公眾索取。

新一期居屋逾70%單位位於市區的兩個屋苑。其中,位於長沙灣荔盈街的凱樂苑兩期合共提供2,522個單位,實用面積由383平方呎至631平方呎不等;位於啟德沐安街的啟朗苑則提供683個單位,實用面積由286平方呎至471平方呎不等。另一個屋苑裕泰苑位於東涌道,提供1,226個單位,實用面積由278平方呎至572平方呎。

新居屋折實後以啟德啟朗苑平均呎價最貴,高達9,755元,單位售價由227萬元至488萬元;長沙灣凱樂苑平均呎價達9,234元,單位面積較大,售價由292萬元至630萬元。東涌裕泰苑折實平均呎價為6,698元,單位售價由159萬元至428萬元。

房委會資助房屋小組於早前通過今期居屋會採用新居屋機制,當中包括將定價由市價7折降至52折,平均售價下調約26%,售價介乎118萬至468萬。

新一期居屋逾70%單位位於市區的兩個屋苑。其中,位於長沙灣荔盈街的凱樂苑兩期合共提供2,522個單位,實用面積由383平方呎至631平方呎不等;位於啟德沐安街的啟朗苑則提供683個單位,實用面積由286平方呎至471平方呎不等。另一個屋苑裕泰苑位於東涌道,提供1,226個單位,實用面積由278平方呎至572平方呎。

新居屋折實後以啟德啟朗苑平均呎價最貴,高達9,755元,單位售價由227萬元至488萬元;長沙灣凱樂苑平均呎價達9,234元,單位面積較大,售價由292萬元至630萬元。東涌裕泰苑折實平均呎價為6,698元,單位售價由159萬元至428萬元。

房委會資助房屋小組於早前通過今期居屋會採用新居屋機制,當中包括將定價由市價7折降至52折,平均售價下調約26%,售價介乎118萬至468萬。

|

HOS 2018 - Details of flats sold by the Housing Authority

Selecting Home: From 28 February 2019

|

||||||

| District | Estate | No. of Unit | Saleable (ft²) |

Price (48% Off) |

Occupancy Date | |

| Cheung Sha Wan | Hoi Lok Court | 2,522 | 383-631 | 2.92-6.30 Million | 2019/8/19 | |

| Kai Tak | Kai Long Court | 683 | 286-471 | 2.27-4.88 Million | 2019/2/4 | |

| Tung Chung | Yu Tai Court | 1,226 | 278-572 | 1.59-4.28 Million | 2020/11/30 | |

| Total : | 4,431 | |||||

The most peaceful law firm in Hong Kong

Remortgage $5,800 (all inclusive)

New HOS Fee $8,300 - (All-inclusive, absolutely no extra charges, including attorney fees for the HA)

HIBOR

Loan to value ratio

Residential of Completed or uncompleted Property

Applicable from Feb 28, 2024

Property Value

Maximum LTV Ratio

Mortgage insurance

Below or Equal to HK$10.00 million

90%*

Yes

Above HK$10.00 million and below or Equal to HK$11.25 million

80% - 90%* (subject to a loan cap of HK$9.00 million)

Yes

Above HK$11.25 million and below or Equal to HK$15.00 million

80%*

Yes

Above HK$15.00 million and below or Equal to HK$17.15 million

70% - 80% (subject to a loan cap of HK$12.00 million)

Yes

Above HK$17.15 million and below or Equal to HK$30.00 million

70%-80%

No

HK$30.00 million to HK$35.00 million

60%-70% (subject to a loan cap of HK$21.00 million)

No

Above HK$35.00 million

60%

No

Note: The newly revised mortgage insurance scheme is applicable to residential properties with provisional agreement for sale and purchase signed on or after Feb 28, 2024

* Mortgage must be undertaken through the [Mortgage Insurance Plan] (MIP) (1) 80% to 90% of the mortgage applicants do not hold any residential properties in Hong Kong; (2) The applicant's income must be a fixed salary; ( 3) Monthly payment cannot exceed 50% of monthly income

Mortgage for non-owner occupancy or more than one property

Property Value

Maximum LTV Ratio

Non-owner-occupied properties or properties held in a company

60%

More than one property mortgage

10% less according to the above ratio

Non-residential property

Property

Maximum LTV Ratio

First Non-residential Property

70%

Second Non-residential Property

60%

Approval at asset level

Property

Maximum LTV Ratio

First Residential Property

60%

Second Residential Property

50%

Debt-to-income (DTI) Ratio

Property

DTI Ratio Limit (Self-use)

DTI Ratio Limit (Non-self-use)

First Residential Property

50%

40%

Second Residential Property

40%

40%